BUSINESS NEWS

Uber IPO is likely to price around $44 or $45 per share: Sources

[ad_1]

Uber’s IPO is likely to price around $44 or $45 per share, sources told CNBC on Thursday. That’s at the low end of the company’s expected range. The company has not yet officially priced its offering.

Its expected range was between $44 and $50 per share, according to a filing last month.

A ride-hailing pioneer and Silicon Valley darling, Uber made on-demand transportation a new norm throughout the world, while accumulating massive losses and controversy along the way.

In 2018, Uber’s revenue reached $11.3 billion for the year, up 43% from 2017, while reporting adjusted losses of $1.8 billion, an improvement over losses of $2.2 billion in 2017. The company has never turned a profit.

To cover these losses and fund its rapid expansion, the company raised more than $24 billion from a wide range of investors since its founding a decade ago, according to Crunchbase. Investors have included traditional VC firms like Benchmark, and companies with interests in transportation like Alphabet and Toyota. Its biggest shareholder is Japanese tech conglomerate SoftBank, which invested more than $8 billion through its Vision Fund and owns 16.3% of the company pre-IPO.

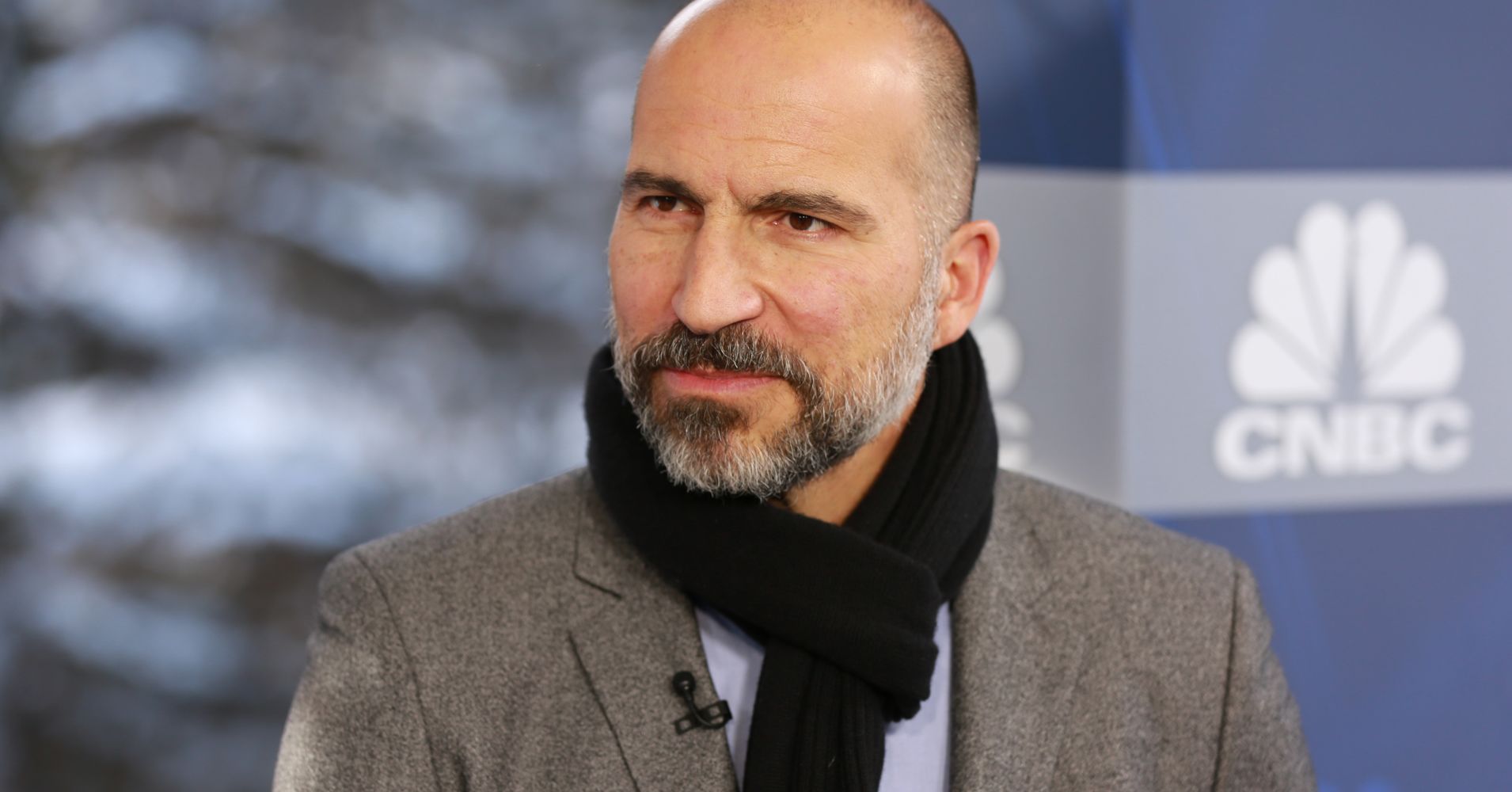

CEO Dara Khosrowshahi replaced co-founder Travis Kalanick in 2017 after myriad missteps for the company Kalanick’s ouster was preceded by revelations about unchecked sexism within the company’s ranks, and a high-stakes lawsuit over trade secrets from Waymo, Alphabet’s self-driving car business.

While Khosrowshahi is working to restore Uber’s reputation, the company faced driver strikes in major cities this week leading up to Uber’s IPO.

Personal mobility remains Uber’s core business. Its ride-hailing services reach into 63 countries and more than 700 cities. But its ambitions and revenue streams have diversified into bike- and scooter-rentals, food delivery and freight. Uber is also developing air taxis and driverless car technology, among other things.

Uber is engaged in an intense pricing battle with its chief competitor in the U.S., Lyft, as the companies try to attract and retain riders with low fares, while paying drivers just enough to keep them on the platform too.

The company plans to list on Friday with the ticker “UBER.”

[ad_2]

Source link