BUSINESS NEWS

10-year Treasury yield is signaling the S&P 500 will do this next

[ad_1]

The yield on the benchmark 10-year Treasury note fell below 2% for the first time since 2016 last week. That move followed a more dovish tone from the Federal Reserve in its June policy statement, with the odds of a rate cut in July moving to 100%, according to the CME FedWatch Tool, after last week’s Fed meeting.

The dip below 2% on the 10-year happened again on Tuesday morning after a disappointing consumer confidence reading, as investors looked for safety with the much weaker-than-expected data hitting its lowest level since September 2017.

The 10-year yield was on the move throughout the trading day Tuesday.

Comments from St. Louis Federal Reserve Bank president James Bullard and Chairman Jerome Powell helped to push the yield back above 2% early on Tuesday afternoon, but later in trading the 10-year note yield hit a low of 1.982%, its lowest level since June 20 when it was near a three-year low. It ended Tuesday trading at 1.992%.

According to history, a move under the key psychological level of 2% on the 10-year treasury note is a big deal, and bodes well for stocks.

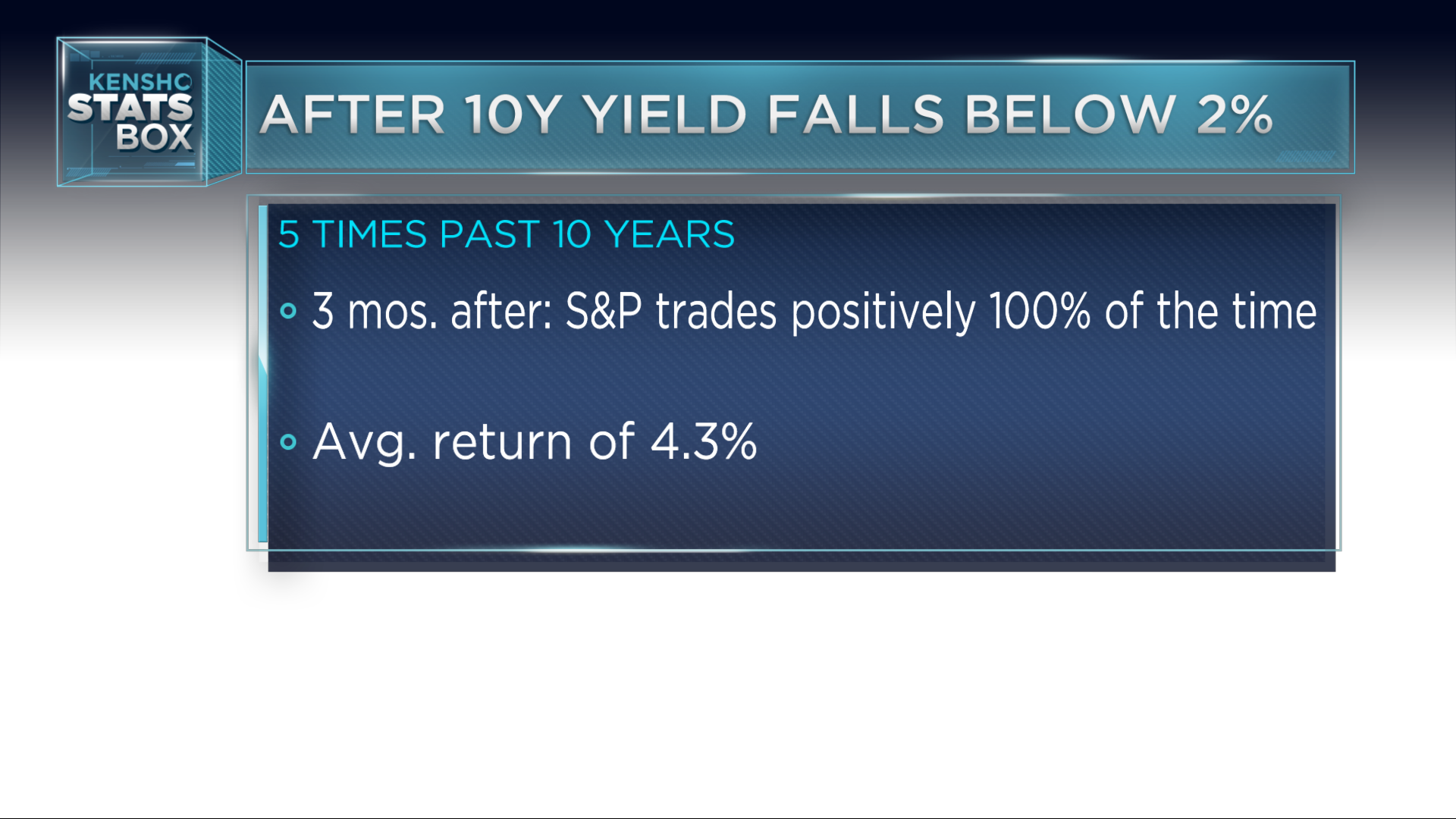

Over the past decade, the 10-year note has dropped below 2% on five other occasions (with a minimum of 3 months between episodes). Three months after these crosses, the S&P 500 Index has traded higher 100% of the time, logging an average return of 4.3%, according to a CNBC analysis of Kensho, a machine-learning tool used by Wall Street banks and hedge funds to identify potential trading profits from historical trading patterns.

Powell stressed the central bank’s independence in a speech Tuesday at the Council on Foreign Relations in New York. The Fed chairman emphasized that policy is under review but did not tip his hand on a rate cut. Markets are currently pricing in four quarter-point reductions by April 2020.

Politics won’t be a consideration, Powell said. “The Fed is insulated from short-term political pressures. … Congress chose to insulate the Fed this way because it had seen the damage that often arises when policy bends to short-term political interests.”

The Dow Jones Industrial Average declined by more than 150 points during Tuesday trading, a slide that began Tuesday morning and ended with a 178-point loss at the close.

Bullard poured cold water over the idea of a half-point rate cut prior to Powell’s remarks, telling Bloomberg, “Just sitting here today I think 50 basis points would be overdone.” He was the only FOMC member to dissent on the Fed’s decision last week to keep rates unchanged. “I don’t think the situation really calls for that, but I would be willing to go to 25. … I hate to prejudge meetings — things can change by the time you get there — but if I was just going today, that’s what I would do.”

Mark Haefele, global chief investment officer at UBS Global Wealth Management, told CNBC on Tuesday, “Bond markets appear to be signaling an economic slowdown, while equities suggest growth will continue in a low inflation Goldilocks scenario. Both stories only make sense if we conclude bond markets are focused on a pre-emptive Fed strike to forestall the risk of a recession, while equities are telling us that the Fed will be successful.”

[ad_2]

Source link