BUSINESS NEWS

Closing a credit card account can hurt your credit score: Survey

[ad_1]

skynesher | E+ | Getty Images

Finally paid off that high-interest credit card balance? Great, but think twice before cutting up the plastic and closing the account.

That’s because doing so won’t help your credit score — and might actually hurt it, according to Bankrate.com.

More from Personal Finance:

How old is too old to still live with your parents?

These moves can tank your credit scores

Debt management impacts retirement dreams

“You should keep old accounts open to boost your credit score, because scoring algorithms look favorably upon longstanding accounts and more available credit,” said Bankrate.com analyst Ted Rossman.

Fifty-eight percent of Americans in a survey didn’t know that closing a credit card account can actually hurt your credit score, according to a survey of 2,582 people conducted this May by Bankrate.com, a New York-based consumer financial services company. A similar 61% have canceled at least one card in their lifetime, while 37% have canceled more than one. Older and/or wealthier cardholders, along with Midwesterners, are more likely to close card accounts.

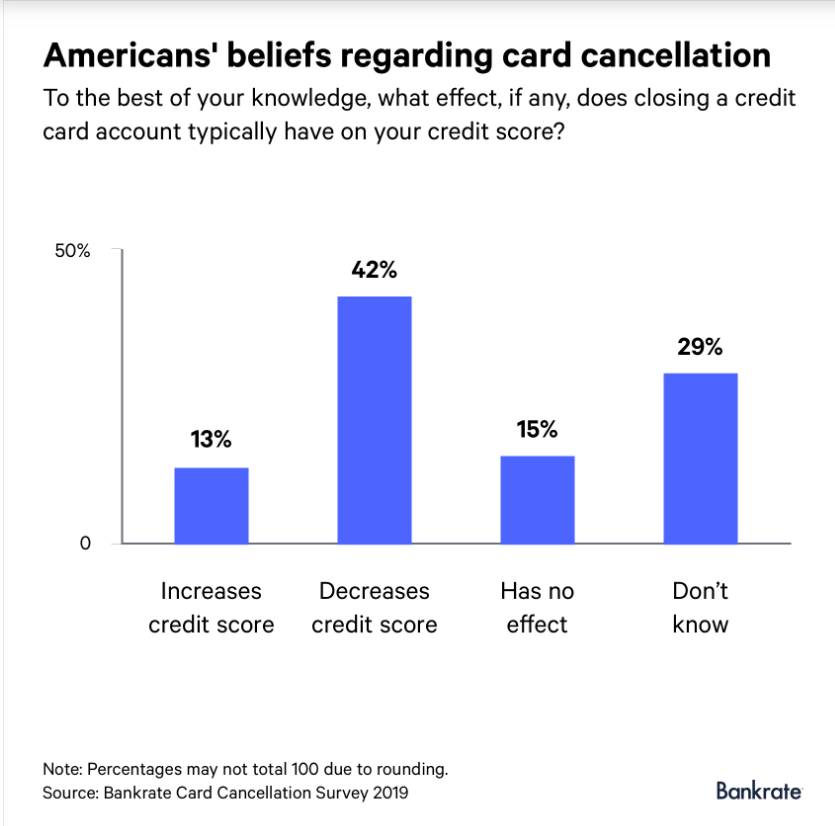

Thirteen percent of card cancelers erroneously think doing so will improve their credit scores, 15% think closing an account has no effect, while 29% have no idea. Only 42% correctly believe it decreases scores. (Percentages do not add up to 100% due to rounding.)

In fact, Shrewsbury, Massachusetts-based Mercator Advisory Group has found that credit card closure rates have more than doubled in the past five years while new account openings have leveled out, according to Bankrate.com.

Other common reasons for taking scissors to plastic include having paid off debt (40%) and lack of card use (36%). The average U.S. card holder has 3.7 active credit card accounts, of which two, on average went unused in the past month, Bankrate.com found.

Weekly advice on managing your money

Get this delivered to your inbox, and more info about about our products and services.

By signing up for newsletters, you are agreeing to our Terms of Use and Privacy Policy.

Why else do consumers clip their cards? High interest rates (36%) and high annual fees (28%). If you’re paying an annual fee for a card you feel you’re not getting much value from anymore, Bankrate.com recommends asking the card issuer to downgrade you to a card without an annual fee.

“A product change like that will not hurt your credit score because it maintains the account history and credit line,” Rossman said.

[ad_2]

Source link